Unrestricted appeal

For unrestricted appeals, the money raised can be spent wherever we choose, as long as it is in line with our charitable objectives, and we typically communicate this as “wherever the need is greatest”.

This may not always be in the country or countries that are given as examples in the appeal, and we’ll make this very clear when we send out the appeal.

Vitally, any unrestricted funds raised can be spent on a very wide range of needs, all of which are critical to ActionAid functioning effectively.

They can allow us to fill funding gaps in less popular projects, pay our building costs and rates, pay staff, or ensure long-term commitments to programmes where funding is sporadic or time-limited.

Restricted appeal

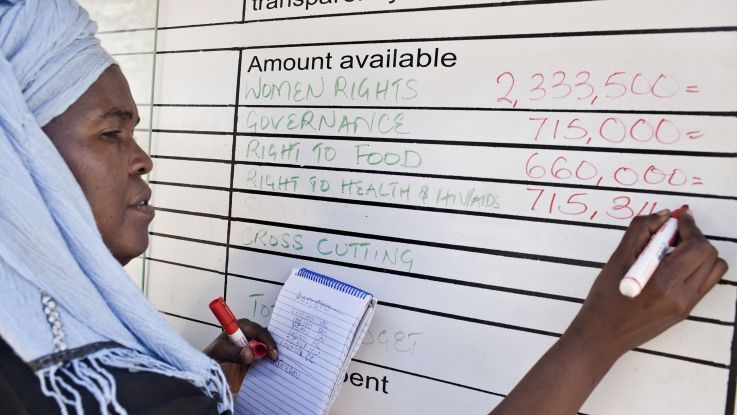

In contrast, we can only use restricted funds for the projects stated in a specific appeal, for example, a response to a humanitarian emergency, or a funding request for support in a particular community.

Most often, this is restricted to country level, to an area within that country, and/or to a specific theme of work.

Since restricted funds are given for very specific purposes, sometimes we’re not able to use those funds as outlined. On these occasions we may need to return the donations to the donor as per the Charity Commission rules unless agreed in advance.

Following are some instances when we may be unable to use restricted funds:

- Because the need has been met in other ways e.g. via other funding.

- Fulfilling the request will require significant administrative support that we aren’t able to provide.

- As can be the case for money left to us in wills, it’s possible that we may no longer be operating in that area or country by the time the funds are received.

Part-restricted or combination of both appeals

It is also possible that appeals can be a combination of both restricted and unrestricted appeals – we call this part-restricted appeals.

In this case, it’s likely that the majority of the donation will go to the main subject of the appeal, but some funds may go towards either related needs (other types of work within that country/area), or unrelated, unrestricted costs to support ActionAid’s wider work.

This split will be clearly highlighted within the appeal literature so that donors will have complete knowledge and understanding of where their funds will be used.

Gift Aid

As part of our fundraising appeals, we also request an optional Gift Aid contribution to your donation.

Gift Aid lets charities claim back 25p from every £1 that you donate.

At no extra cost to you, ActionAid can claim this money from the Government from the basic tax that has already been paid on your donation.

We claim Gift Aid back from HM Revenue & Customs (HMRC) and this will always be treated as unrestricted funding, even if the original donation is restricted.